With April 15, tax day in the USA, having just recently passed, it is appropriate to reflect on the mantra that the rich are not paying their “fair share” of taxes, but are ripping off the poor, who allegedly are overwhelmed by the burdens the federal government is imposing on them to give to the rich.

What part do the rich and the poor pay?

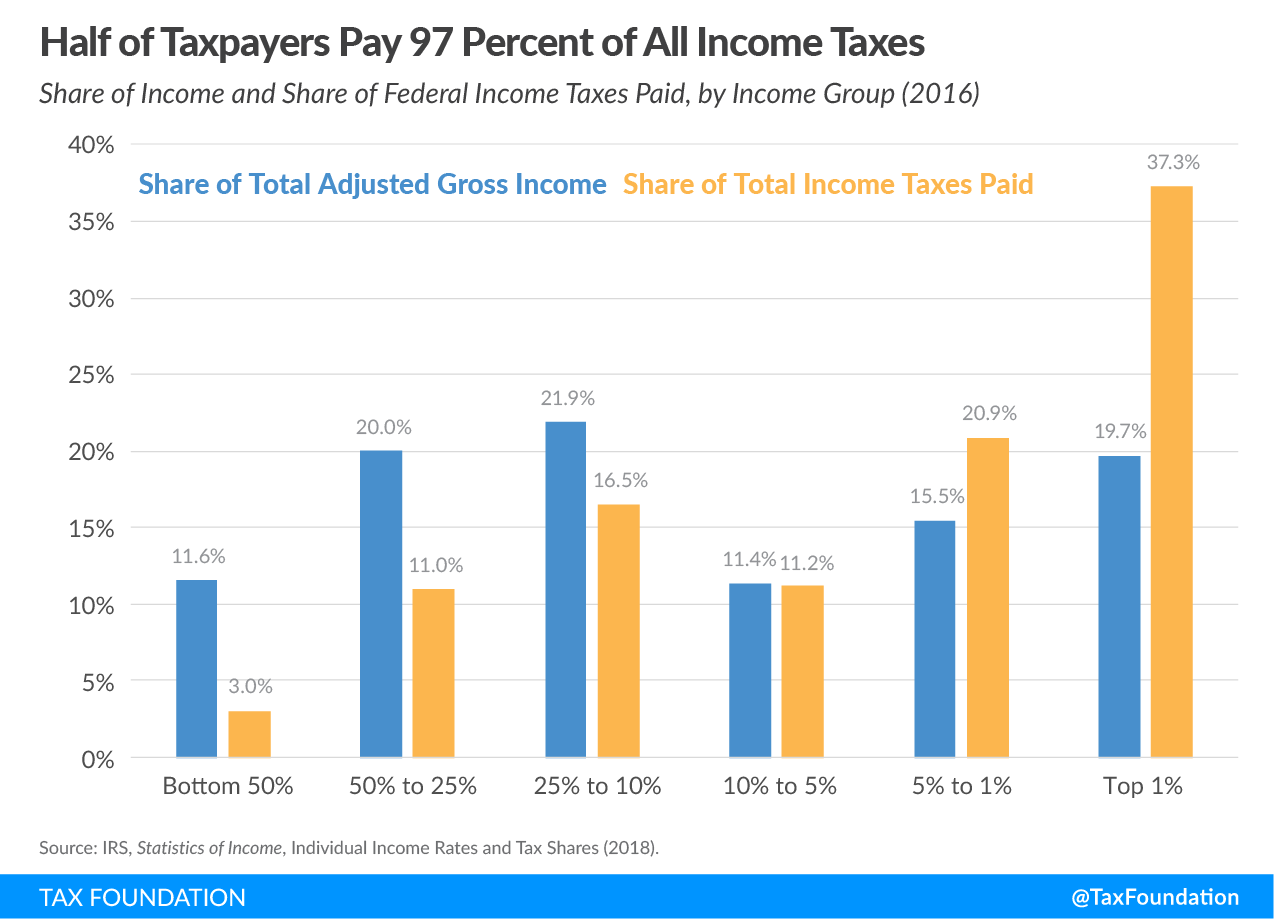

The top 50% of tax payers paid 97% of all income tax in 2016, and the figures are about the same today. The top one percent paid 37% of all income tax.

Approximately 44% of all lower-income workers will pay no income tax at all. In other words, they are not just failing to pay their “fair share.” They are paying no share. The rich are paying their fair share–in fact, they are paying far more than their fair share. The government is stealing from the rich.

The large majority of what is stolen from the rich goes to unconstitutional “redistribution” of wealth–it is the government using force and the threat of fines and imprisonment to take from one person and give to another:

What is a “fair share”?

Enemies of the free market and advocates of socialism and of “redistribution” of wealth rarely define what the “fair share” is that they want the rich to pay. However, the Bible clearly states what the maximum just level is for an income tax. In the words of the tract The Role of Government: Has God Spoken?:

In economics, God teaches that taxation on income should be below a flat 10% rate—any higher rate is a curse and a form of slavery (1 Sam 8:6-8, 15, 17-18). “Redistributing” wealth—the government taking from one person by force through taxation to give to someone else it believes is more worthy—is ungodly (1 Sam 8:14-15). Governments that redistribute wealth are stealing (Ex 20:15), just like a robber who “redistributes” what a person owns. Such practices are considered in Scripture to be pagan (1 Sam 8:19-20), tyrannical (1 Sam 8:17-18), and oppressive (1 Sam 12:3). Devaluing currency—as the government does by inflation—is also stealing (Isa 1:22, 25). National debt is a curse (Deut 28:12, 44). Bribery—including bribing certain classes of people to vote a certain way by promises of government handouts—is a sin and “perverted judgment” (1 Sam 8:3), for the government is to be impartial and neither favor the rich or poor (Deut 16:19; Ex 23:3; Prov 22:16). God commands individual believers and churches to generously and selflessly help the needy and poor (2 Thess 3:10; Gal 6:10; Lu 6:35), and not to do so is sinful, but for the government to employ force to extract money from people to give to either the rich or poor is the sin of stealing, not charity or generosity. The Bible teaches an economic system that values private property (Ex 20:15), free enterprise (Mt 20:2), and economic freedom (Mt 20:15), rather than socialism, fascism, or communism.

Any income tax above the tithe–above the 10% that God requires for Himself–is stealing and iniquity, not justifiable taxation. 10% is the maximum Biblically justifiable tax rate. Furthermore, the tax rate should be flat–the poor should pay at most 10% of $1,000, namely, $100, and the rich should pay as a maximum 10% of $1,000,000, namely, $100,000. Therefore, every tax bracket in the USA, except perhaps the very lowest one, is sinful, and the rates become more sinful the more people earn:

2018 Tax Year Individual Income Tax Rate Schedule

|

Tax Rate

|

Single

|

Married/Joint

& Widow(er) |

Married/Separate

|

Head of Household

|

|

10%

|

$1 to $9,525

|

$1 to $19,050

|

$1 to $9,525

|

$1 to $13,600

|

|

12%

|

$9,526 to $38,700

|

$19,051 to $77,400

|

$9,526 to $38,700

|

$13,601 to $51,800

|

|

22%

|

$38,701 to $82,500

|

$77,401 to $165,000

|

$38,701 to $82,500

|

$51,801 to $82,500

|

|

24%

|

$82,501 to $157,500

|

$165,001 to $315,000

|

$82,501 to $157,500

|

$82,501 to $157,500

|

|

32%

|

$157,501 to $200,000

|

$315,001 to $400,000

|

$157,501 to $200,000

|

$157,500 to $200,000

|

|

35%

|

$200,001 to

$500,000 |

$400,001 to $600,000

|

$200,001 to $300,000

|

$200,001 to $500,000

|

|

37%

|

over $500,000

|

over $600,000

|

over $300,000

|

over $500,000

|

(Note that the bottom brackets are essentially not really what they appear to be because various credits cancel out the tax rate--people in the 10% income bracket, for example, are almost certain to really pay 0%, having all their income tax returned to them.)

Biblically, the government is simply to be like a night watchman, punishing evil (Romans 13) and doing nothing except offering praise to what is good, rather than funding what it believes to be good through taxation. Were the government to cease its sinful "redistribution" or stealing of people's private property through unbiblical spending, it could definitely both tax at below a 10% flat rate and also balance its budget and pay off the national debt.

Why the poor should be taxed

A flat tax is appropriate, not only because of the (entirely sufficient) reason that God says that it is, but also because it is very important for everyone to have "skin in the game." When 44% or so pay no income tax at all, they have no incentive to fight for lower taxes and spending--rather, they have every incentive to vote for politicians who promise to steal more from other people and "redistribute" the goods of others to themselves.

Furthermore, a flat tax rate of less than 10% would result in much faster economic growth, making both rich and poor more wealthy.

It should be noted that in America the "rich" and the "poor" are highly fluid, not static, categories. It is not that hard to become a millionaire in the USA. (See the IRA calculator here, for example--just start early enough and it is highly likely you will be a millionaire if God spares your life). Furthermore, if you avoid the "strange woman" of Proverbs and work, you have less than a 2% chance of being below the poverty line. What is more, the "poor" of the USA are not really poor--they are far better off than the vast majority of people in the world today, and far better off than just about everybody that lived in past centuries.

Thus, the poor that fear God should protest against the fact that other more wealthy Americans are having their property unjustly stolen by the government, and they should vote against programs that give them the stolen goods of others. (I'm not holding my breath.)

Far too often (though not always), people are poor because of sinful behavior--drugs, alcohol, sexual immorality, etc.--and government welfare programs actually make their situation worse, not better. Rather than stealing money from the wealthy through unjust taxation, the government should praise the wealthy who give generously to true churches that preach the gospel that changes the lives of drug addicts and other sinful lifestyles and cleans them up. From a secular viewpoint, an organization such as Kiva does far more to help the poor in the USA and around the world with the money it has than the government does with the funds that flow through its "redistribution" schemes.

Conclusion: Tax the poor

In conclusion, the rich are indeed not paying their "fair share"; they are paying much, much more than their fair share. The poor, by contrast, are not paying their "fair share"; a huge percentage of them are paying no share at all. These facts are ungodly, like many of the other things that the government does, the worst of all being allowing the slaughter of helpless infants in the womb.

Politicians will never say what this blog post says, because it would be highly unpopular and they would be out of a job the next election cycle. (To be even more politically incorrect, you should not give the homeless money either--they are almost certain to spend it on drugs or alcohol, not food.) Visualize the soundbites and headlines now: "Politician says to tax the poor and give nothing to the homeless," followed by pictures of needy people, while ignoring the fact that the role of government, not of private charity, is under discussion. It is not the role of government to be "generous" with other people's money--it is the duty of individuals and churches to be generous with their own money. While politicians will never say these things, they are, nevertheless, the truth. The rich are paying too much in taxes, and the poor are not paying their fair share. The government is wickedly violating the eighth commandment, "Thou shalt not steal" (Exodus 20:15), and God's sword of justice will not always sleep.

-TDR

Dear Anonymous,

If you put your name on your comment, we'll publish it, even though it is insulting.

The answer to your question about "who knew" a 10% tax rate was sinful, "LOL," is "Anyone who studied 1 Samuel 8 carefully knew." When you laugh at what God through the prophet Samuel says is pagan, heathen, tyrannical, and judgment, namely, a 10% tax rate, you take the side of the wicked Israelites who wanted tyranny rather than the freedom–and no tax rate of 10%–in the Hebrew republic God instituted.

Thanks.

I agree with Thomas. Redistribution of wealth, which occurs through a graduated tax system, takes something from someone who has earned it and gives it involuntarily to someone who did not. One of the possible evils of a democracy is mob rule. I think it's also important to debunk this idea on a regular basis, to push back against it.

Look at Beto O'Roarke as an example. His tax returns showed that he made $366,455 in 2017 and he gave away voluntarily $1,166, which is .3% of his income. In 2016, he and his wife, gave 857, and in 2016, 867. Only one year since 2008 have he and his wife gave more than 1% of their income, which has been over $300,000. He wants to raise taxes on people or in other words, confiscate other people's money they earned by force. This is corrupt.

Readers and Anonymous (who has sent 4 or 5 comments),

Your comments don't prove anything. They are not being published because they are anonymous and they are insulting. If you are going to use mainly name-calling, which is not something we want to publish either, you've got to put down your real name. It's interesting though how dedicated you are to taxation, that you would keep trying without including your name. Just give your real name with some verification of who you are. That you don't do that is cowardice.

You know very well that you sinned when you slandered Beto. I really don't think you have the humility to admit it publicly but unless you do, you are just a fraud.

Readers,

Anonymous came back with about his 6th or 7th comment to Thomas Ross's post. I just came in to support Thomas because this guy was writing these types of comments and even longer, and anonymous. I want everyone to see the last one, just as a sample. He's writing it to me, saying that I slandered Beto O'Roarke, when all I did was cite statistics that anyone can get. If they are not true, someone can just show how they are false. They are very exact. I also heard him explain why he didn't give very much money, and he essentially said it was because of how valuable his time was, so that his time counted far more than any amount of money he could give. I can't help but laugh at O'Roarke's defense. What's amazing is that he isn't the most airheaded candidate on the left. There are even worse, and anonymous wants to defend me by saying that I'm not humble, I'm a fraud, and I'm sinning by slandering. Ooookay. Fake news.

Read the comment though. It speaks for itself.

Anonymous,

I'm not printing your comments because you are just insulting and your anonymous. A lot of blogs don't publish any anonymous comments, and especially those who just do name calling. May name is out here. If we are frauds and I'm a fraud, like you say, behind your computer in an anonymous way, then prove it from the passage that Thomas is wrong. He refers to God's Word and does prove it. I haven't heard any proof from you, just ad hominem argument, and what you are saying is a lie.

Related to O'Roarke, everything I said was true.

OK Kent, I am about done here. I will leave you with a few thoughts.

1) If you think Thomas proved that an income tax over 10% is a sin, you need to examine your ideas of exegesis carefully. He proved nothing of the sort. I am not going to waste time arguing against jello. If he actually got a windmill up rather than a mirage of one, I might tilt against it. But there is a reason that there are like 4 people in the world believe his assertion; it is rubbish. It is not worth a thinking person's time.

2) You can keep playing cute games with what I said about O'Roarke. Like I said, it makes you either dishonest or a fool. I think it makes you dishonest. You wrote about his tax returns to try to demonstrate he is not generous with money. It proves no such thing. The IRS is not the final source on what generosity is and you cannot reduce generosity to a line on a tax return. I give away money constantly to people that need it and not a dime of that shows up on a schedule A. I walked through my business recently and handed every employee a $100 bill. That will not show up on a schedule A either.

I think you are smart enough to know this which is why your smear on O'Roarke is dishonest. You hate the IRS but yet you are willing to let them decide who is generous or not? What a bunch of crock.

This is the last time I am going to say these things. You are basically acting like a politician yourself. You want to pick out a phrase and spin it and in general portray my comments dishonestly as well on your blog. What you really need to do is publicly apologize for your sin.

And before you do your normal, reading into my motives and saying I support high taxes or liberals, try again. I despise both. I would not waste an hour eating lunch with O'Roarke.

Readers,

If someone was going to go after me on this blog, this is an interesting one, someone who is interested in higher taxes than 10%. I said, interested, which is a very ambiguous word. I'm judging Thomas's argument based upon reading the text of scripture. I see it there, and I think he is applying it properly. It provides an objective nature to the tax situation and God does it. Anonymous doesn't provide and refutation, except illogical, ad hominem and bandwagon. He says no one else is making this argument. Very few people, it is true, make scriptural arguments, but they are out there. This isn't new, what Thomas is exposing.

Regarding Beto, my sole point was to show the hypocrisy of the left. They want to take from others, but when it comes to their own money, they don't want to do it themselves. He is one of many. You might remember Al Gore in his 2000 race, tax forms, same thing. Beto didn't say that he had actually given a lot of money and didn't report it. No, he said, my time is worth so much that it is more valuable than money. This is accurate representation of him.

I also allowed this one because it has far less name calling, but in tone, you can see who they are, using the language they do. I'm letting you read it.

Dear Anonymous,

Here is a prominent Christian think-tank on economic theory that makes the same 10% argument:

http://www.trinitylectures.org/MP3_downloads.php

They probably have more than the four people you are talking about listening to them.

I'm sure that the reason Beto's tax return shows extreme lack of generosity is because he is giving, not to approximately four people, but because he is so generous and just doesn't record it on his tax return. That, for sure, isn't a jello argument–it is sound, very sound.

The ironic thing with him is that he has wanted to run for president for a long time and was so stingy that he didn't think about giving a lot for returns he knew would get released. The Clintons were smarter than Beto here.

Dear Anonymous,

In relation to your argument here:

1) ]The passage does speak somewhat negatively of a tenth. It does not say it is a sin to collect a tenth.

2) The passage speaks specifically about a tenth, not more than a tenth. If anything is a "sin" because of this passage, it is a 10% tax, not a 20% tax.

3) The tax is on possessions, not income. It would be like taxing assets rather than income which by the way is not something that even today's liberals are advocating for outside of property tax. So this passage has NOTHING to do with Thomas' assertion from a fiscal standpoint.

There are a dozen other problems with his "exegesis" as well but I will start with those three.

So you would view the rejection of God as king, the rejection of the Hebrew republic, and the adoption of a king to be like the heathen nations as "somewhat negative"? In 1 Samuel it is called "great wickedness" (1 Sam 12:17, 20).

So you really think 1 Sam 8 is only talking about the king taking 10% of the seed, the sheep, etc. one time and then leaving everyone else alone after that? It wasn't like the tithe given to God, but now it is given the king? (This is not to say that the king would not also arbitrarily confiscate goods–the king does other wicked things in 1 Sam 8 that undermine property rights). So the king's officers and government officials could live off everyone else by only taking 10% one time and then leaving them all alone the rest of their lives?

So they were going to be crying out in pain over what the king would do (1 Sam 8:17) at 10%, but it was fine at 15%, 20%, 25%?

So is my exegesis in question marks, or does yours deserve them?